Germany v. Russia, FedEx Stock Drop, Warren Wisdom, Recession Prediction, Euro Energy Jam, PE Deal Volume

"There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know."

- John Kenneth Galbraith

BUSINESS

Germany Seizes Assets of Russian Oil Giant Rosneft

- Berlin moves to take sweeping control of its energy industry, secure supplies and sever decades of deep dependence on Moscow for fuel.

- Chancellor Olaf Scholz’s administration is in advanced talks to take over Uniper SE and two other major gas importers.

- The need for action is urgent with Uniper losing 100 million euros ($99.7 million) a day as it tries to replace Russian gas to maintain deliveries to local utilities and manufacturers.

- Because of sanctions related to the war in Ukraine, Germany is preparing to stop buying Russian crude by the end of the year and needed to make sure Kremlin involvement in its key refineries didn’t become a threat.

Global Instability and Software’s Opportunity (Palantir CEO Alex Karp and Stanley Druckenmiller)

- Druckenmiller is an investor in Palantir (minute ~34: “I bought your stock in I think it was 08, maybe it was 09.”) and his daughter works there as well

- Much of the conversation is about geopolitics, ‘global instability,’ issues of culture and governance, and the role that Palantir can play.

via Neckar's Minds and Markets

How a CEO Rescued a Big Bet on Big Oil

- Occidental Petroleum’s Vicki Hollub fended off a shareholder revolt led by Carl Icahn. Lifted by rising crude prices, she now has the confidence of Warren Buffett.

- OXY entered the thick of the pandemic among the worst prepared of its U.S. oil-and-gas peers. Struggling with debt from an ill-timed $38 billion deal.

- ...the company has emerged as the top performer in the S&P 500, and Ms. Hollub has traded Mr. Icahn, who sold all of his Occidental shares in March, for Warren Buffett, whose Berkshire Hathaway now owns more than 20% of the company.

- Ms. Hollub, the first woman to be CEO of a major U.S. oil company, says she doesn’t feel vindicated. “I just feel relief,” she said. “There were a lot of doubters.”

INVESTING

FedEx stock sold off over 20%

- after it updated its business outlook, saying that. “Global volumes declined as macroeconomic trends significantly worsened later in the quarter [ending August 2022], both internationally and in the U.S.”

- In 2020, FedEx stock rose over 70% as FedEx’s distribution became critical to many households.

- So the trajectory of FedEx stock price doesn’t necessarily always match global growth.

- This marks FedEx’s worst one-day drop in history — topping the 16% plunge the day of the 1987 stock market crash.

Warren Buffett's Timeless Advice When Stocks Are Falling

- "If you have a temperament that when others are fearful you’re going to get scared yourself, you know, you are not going to make a lot of money in securities over time, in all probability."

- "If you buy a farm, do you get a quote next week, do you get a quote next month? If you buy an apartment house, do you get a quote next week or month?"

- "When it goes down we love it, because we’ll buy more. And if it goes up, it kills us to buy more."

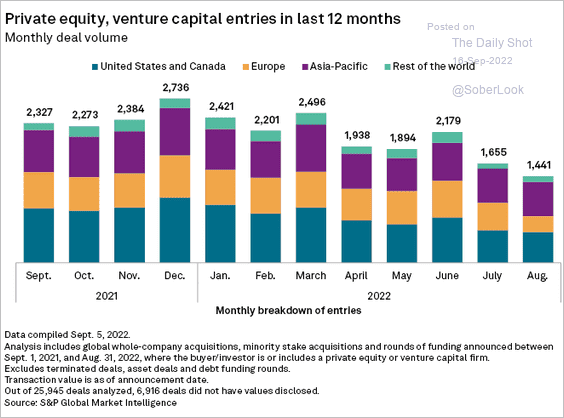

Private Equity Deal Volume Trending Lower

Reflections on the Investing Process with Michael Mauboussin

- “Great investors do two things most of us don’t. They seek information or views different than their own and they update their beliefs when the evidence suggests they should. Neither task is easy.”

ECONOMICS

Predicting the Next Recession

- Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession.

- And this most common cause of a recession is the current concern. Since inflation picked up, mostly due to the pandemic (stimulus spending, supply constraints) and due to the invasion of Ukraine, the Fed has embarked on a tightening cycle to slow inflation.

- The key will be to watch housing. Housing is the main transmission mechanism for Fed policy. One of my favorite models for business cycle forecasting uses new home sales (also housing starts and residential investment).

The Fed Stopped Buying MBS

- September 14, the Fed conducted its final purchase of MBS. The Fed bought $387 million in MBS in the To Be Announced (TBA) market...

- The purpose of MBS purchases was to repress mortgage rates and inflate home prices. That process has already started to reverse.

- The Fed has said many times over the years that it wants to get rid of its MBS entirely, and that it wants only Treasury securities as assets. So if everything goes according to plan, the MBS balances will go to zero.

FedEx CEO Calls "Worldwide Recession"

- FedEx CEO Raj Subramaniam told CNBC’s Jim Cramer on Thursday that he believes a recession is impending for the global economy.

- The CEO’s pessimism came after FedEx missed estimates on revenue and earnings in its first quarter. The company also withdrew its full year guidance.

- Weakening global shipment volumes drove FedEx’s disappointing results.

- While the company anticipated demand to increase after factories shuttered in China due to Covid opened back up, it actually fell

How Europe Stumbled Into an Energy Catastrophe

New York Magazine interviews the Doomberg writers.

- On U.S. and European attempts to use economic sanctions to cut off Russian oil: When you’re the swing producer like Russia... you are the single largest exporter of energy that the world desperately and critically needs, you hold all the cards.

- You can’t print molecules. You can’t print energy. If you head into the winter without enough energy... you could have chaos.

- What we’re experiencing today — bailouts by the hundreds of billion — electricity prices up by a factor of 14 or 15 before coming down by a third and everybody cheering … this is Weimar-like stuff.

- The world literally cannot live without Russia’s energy... We should be flooding the market with energy. Every molecule that Putin’s willing to sell his enemies in Europe should be accepted.

EXTRA

- California’s Fast-Food Fumble (Hoover Institution)

- Discipline is Destiny: 25 Habits That Guarantee You Success (Ryan Holiday)

Disclosure: I/we have a beneficial long position in the shares of Palantir (PLTR) either through stock ownership, options, or other derivatives. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Comments ()