U.S. Audits China Firms, Retail Sales Up, Eiffel Tower Lights Out, Mortgage Rates Highest Since '08, "Price Matters Again", Quiet Firing

“History never repeats itself. Man always does.”

- Voltaire

Investing

U.S. Audit Inspectors Heading to China After Landmark Agreement

- Inspectors from the U.S. Public Company Accounting Oversight Board are preparing to travel to Hong Kong to begin reviewing the audit files of publicly traded Chinese companies.

- The process would take eight to 10 weeks. “So we’ll probably know somewhere around Thanksgiving or early December,” said SEC Chairman Gary Gensler.

- Outcome of inspections could determine whether Chinese stocks are allowed to continue trading in U.S.

Why Investor Behavior Never Changes

- Human behavior never changes, hence, investor behavior never changes

- And therefore, markets will never change.

- Keep this in mind next time you watch a video or read a piece that talks about how investing has changed forever now because of xyz.

- To be a good investor, we should not only focus on learning the fundamentals or technicals of investing, we should also learn about the behavior of humans.

- When you learn lessons about the nature of humans, you can apply those lessons to what’s going on in the world.

Darius Foroux

Tweedy, Browne: "Price Matters Again"

- We've been through a 10-year period, going back to 2012, that's been a very tough stretch for value investing. That directly relates to the environment of zero to negative interest rates and the untethering of investor perception from fundamentals.

- If you believe, as we do, that interest rates could be higher for longer given what seems to be a more persistent than expected inflation, it means that valuation matters again.

- In a rising interest rate environment, particularly one where rates might normalize higher, fixed-income instruments become competitive again.

- Discount rates, which are used in valuation analysis, are up, and that tends to favor nearer term risk assets as opposed to longer duration risk assets. That tends to favor the types of stocks we look at over time.

- We're quite positive and optimistic today and one of the reasons for our optimism is that price once again matters.

Here’s What Happens To Stocks When The Fed Raises Rates By 100 Basis Points

- Though most Wall Street experts still predict that the Federal Reserve will raise interest rates by 75 basis points next week, expectations for a more aggressive 100-basis-point hike have slowly been rising.

- The last time the central bank raised rates by 100 basis points was over four decades ago, when Paul Volcker was Fed chairman.

- The Fed raised rates by 100 basis points seven times between November 1978 and May 1981 (after Volcker had taken the helm).

- Inflation stood at 9% in November 1978 before peaking at 14.6% in March 1980, while core inflation was at 8.5%—peaking at 13.6% in June 1980.

- Markets fell nearly 60% of the time, with the S&P 500 losing an average of 2.4% one month after a 100-basis-point rate hike.

Business

From Shortage to Glut: Scotts Miracle-Gro Is Buried in Fertilizer

- After two years of struggling to fill store shelves, the company had ramped up production to catch up with consumer demand for lawn seed, fertilizer and other garden products.

- Scotts asked stores why they reduced orders and learned they planned to carry lighter stock.

- They had stocked up on merchandise of all sorts before realizing that consumer spending patterns shifted as the pandemic eased, leaving them with bloated inventory that would take months to whittle down.

- The big jump in inventory tied up cash—as of the end of June, Scotts had just $28 million in cash, down from $244 million at the same time last year.

- The existing fertilizer inventory won’t spoil so it can be sold off into next season, and the company doesn’t plan to cut prices to move it.

- Scotts has already cut about 450 jobs, or around 6% of its workforce, since May, and more layoffs are coming.

We all know about ‘quiet quitting.’ Now there’s ‘quiet firing'

- Quiet Quitting: Doing the bare minimum, ceasing extra effort, not committing to the company culture.

- Quiet Firing: Instead of properly managing an employee, bosses shirk their duties and hope they’ll quit.

- “Quiet firing is a rebranding of a concept that’s been around for a while,” says Annie Rosencrans, director of people and culture at HiBob, a people management platform.

Economics

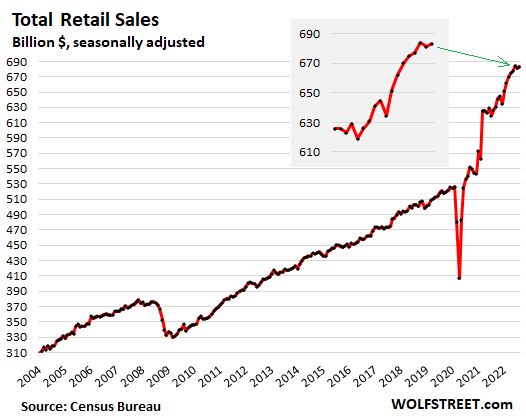

U.S. Retail Sales Rose 0.3% in August

- Shoppers spent more on vehicles, groceries and clothing as gasoline prices eased, showing persistent demand despite high inflation.

- Shoppers had some additional wiggle room in August because of falling gasoline prices.

- Americans spent less at gasoline stations last month and more in many other categories

WSJ - Compared to August 2019, the last normal year, total retail sales were up by an astounding 31.1%.

- Retail sales track sales of goods, not of services. And inflation has been shifting from goods to services.

- Gas stations: Sales dropped 4.2% for the month, to $64 billion, the second month in a row of declines, as gasoline prices fell.

- Sales at gas stations include the other stuff they’re selling.

Wolf Street

The Eiffel Tower’s famous lights will start shutting off early

- To save energy, the Eiffel Tower will go dark at 11:45 p.m. each night.

- The new cut-off time for the tower’s lights begins September 23, Paris Mayor Anne Hidalgo announced

- It is part of the city’s plan to reach a 10% energy savings.

- The initiatives come amid soaring electricity prices, not only in France but throughout Europe.

- Russia, which last year provided about 40% of the EU’s gas, cut its supply this year due to its war in Ukraine.

Real Estate

Mortgage Rates Surpass 6% For First Time October 2008

- Freddie Mac reports the 30-year fixed mortgage rate is 6.02%, up from 5.89% last week.

- That’s the highest it’s been since the 6.46% rate on October 30, 2008—just two weeks after the Dow Jones Industrial Average had its worst week ever at the time, falling 18%.

- Rates are more than double what they were one year prior, when they were 2.86%.

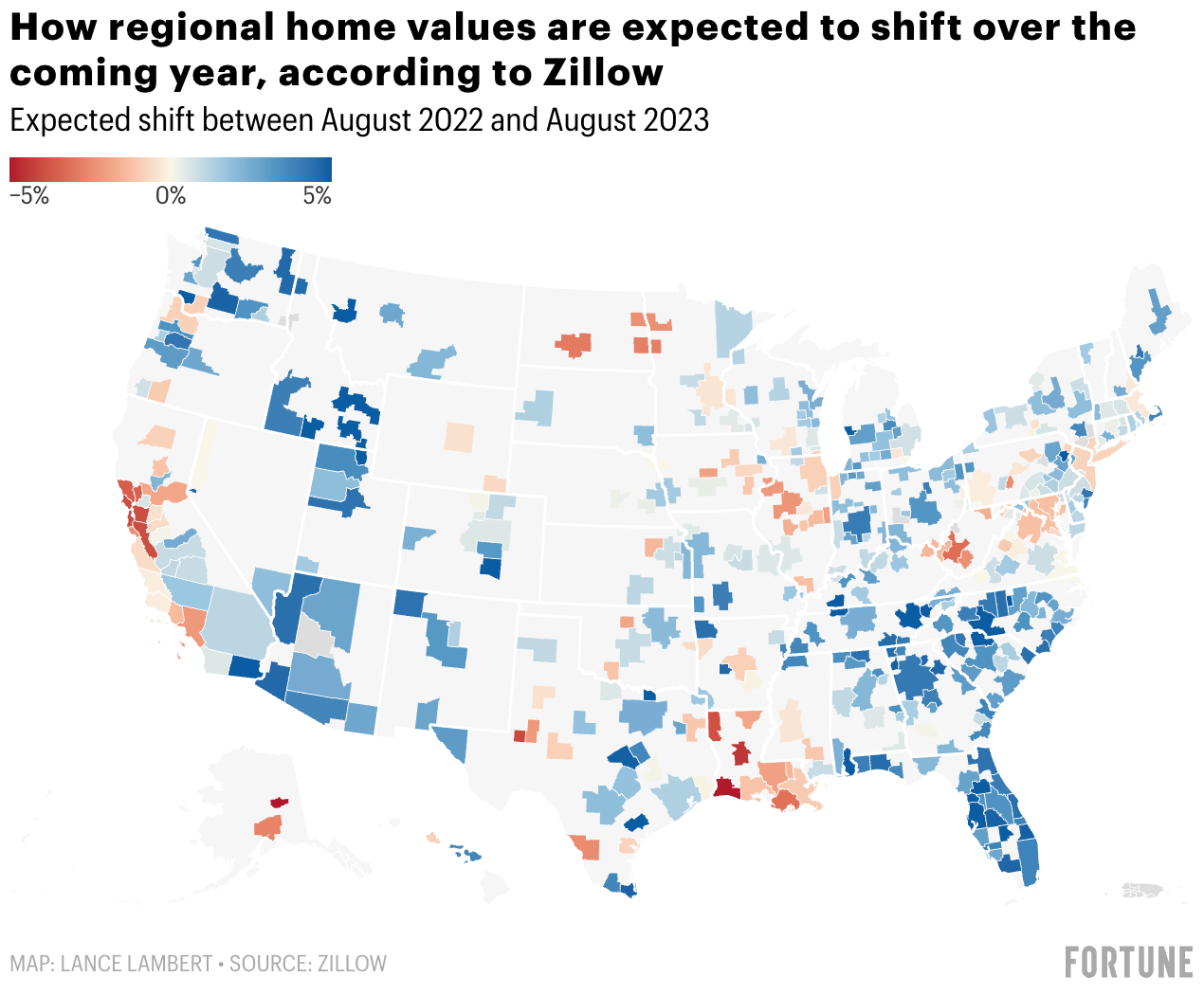

Home prices to fall in 259 markets while 615 go higher

- Zillow predicts that 259 of the nation’s 896 regional housing markets are likely to see declining home values

- Zillow forecasts that 615 markets are poised to see higher home prices over the coming year. Another 22 markets are predicted to remain flat.

- Over the next three months, Zillow predicts that home values will fall in 552 markets. This is due to interest rate hikes.

Misc

If you read this on a smartphone, you’re probably not going to understand it

- Reading texts on a smartphone requires more concentration and is harder for your brain.

- People are not concentrating as much on the content itself and as a result, have a worse understanding of the content of the text than people who read the same text on paper.

- Indeed, the people who read a text on paper can expend more of their mental resources on the content of the text and introspection.

Read Yesterday: ETH Merge, Overheaters Prison, Flat Market, Food Prices Soar

Comments ()