The Infinite Game, Home Prices Decline, OpenDoor's Awful August, High-Earners v. High Taxes

"It is possible to make money— and a great deal of money—in the stock market. But it can't be done overnight or by haphazard buying and selling. The big profits go to the intelligent, careful and patient investor, not to the reckless and overeager speculator." - J. Paul Getty

ECONOMICS

The Stock Market Is Not The Economy

- International exposure is an important thing which differentiates the U.S. economy from the U.S. stock market. Even though they are closely tied.

- "According to FactSet, S&P 500 companies generate around 40% of revenue outside of the U.S."

- Think about this when you are tempted to only consider events within the U.S. economy and their effects on companies.

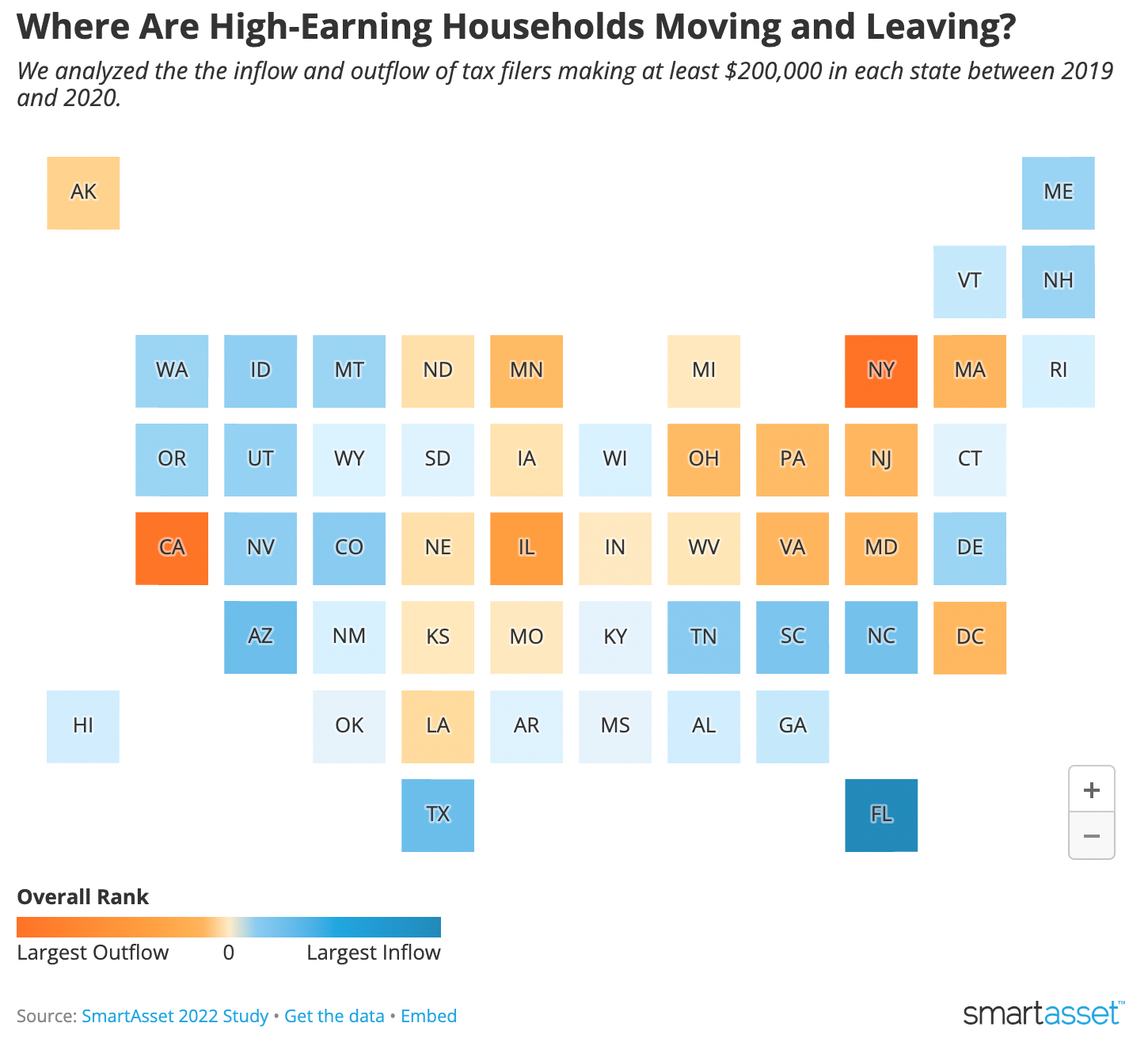

High-Earners Seem To Dislike Higher Taxes

- SmartAsset examined inflows/outflows of tax filers making at least $200K/yr in each state between 2019 and 2020.

- Four of the top ten states receiving the largest net inflows of high-earners have no state income tax: Florida, Texas, Nevada and Tennessee.

- Florida saw the greatest gains of high-income earners with a net inflow of 20,263.

- High tax states lost the most high-income earners. New York's net outflow: 20,000. California's net outflow of high-earners was 19,229.

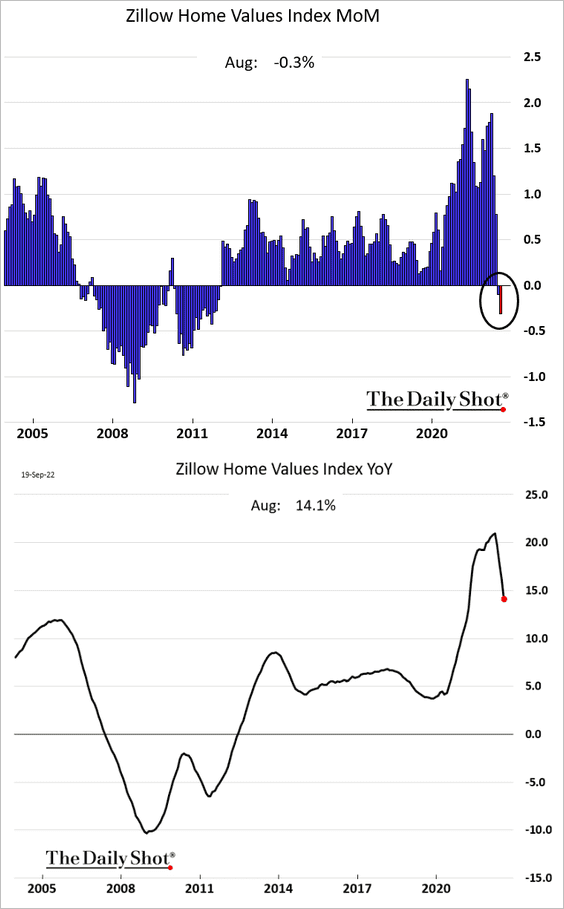

Home Prices (MoM) Decline For First Time in Over a Decade

INVESTING

Waiting For The Bottom Is a Terrible Idea

Some investing wisdom from a video interview with the generously insightful Howard Marks of Oaktree Capital.

- Attempting to time the bottom of any market is generally a bad idea. Many gains are missed by investors who try to call bottoms or tops of markets while their cash sits on the sidelines.

- "...you never know when you’re at the bottom. And the bottom comes about because everybody achieves maximum pessimism and at that time very few people are capable of buying all right." - Howard Marks

Full Interview (YouTube)

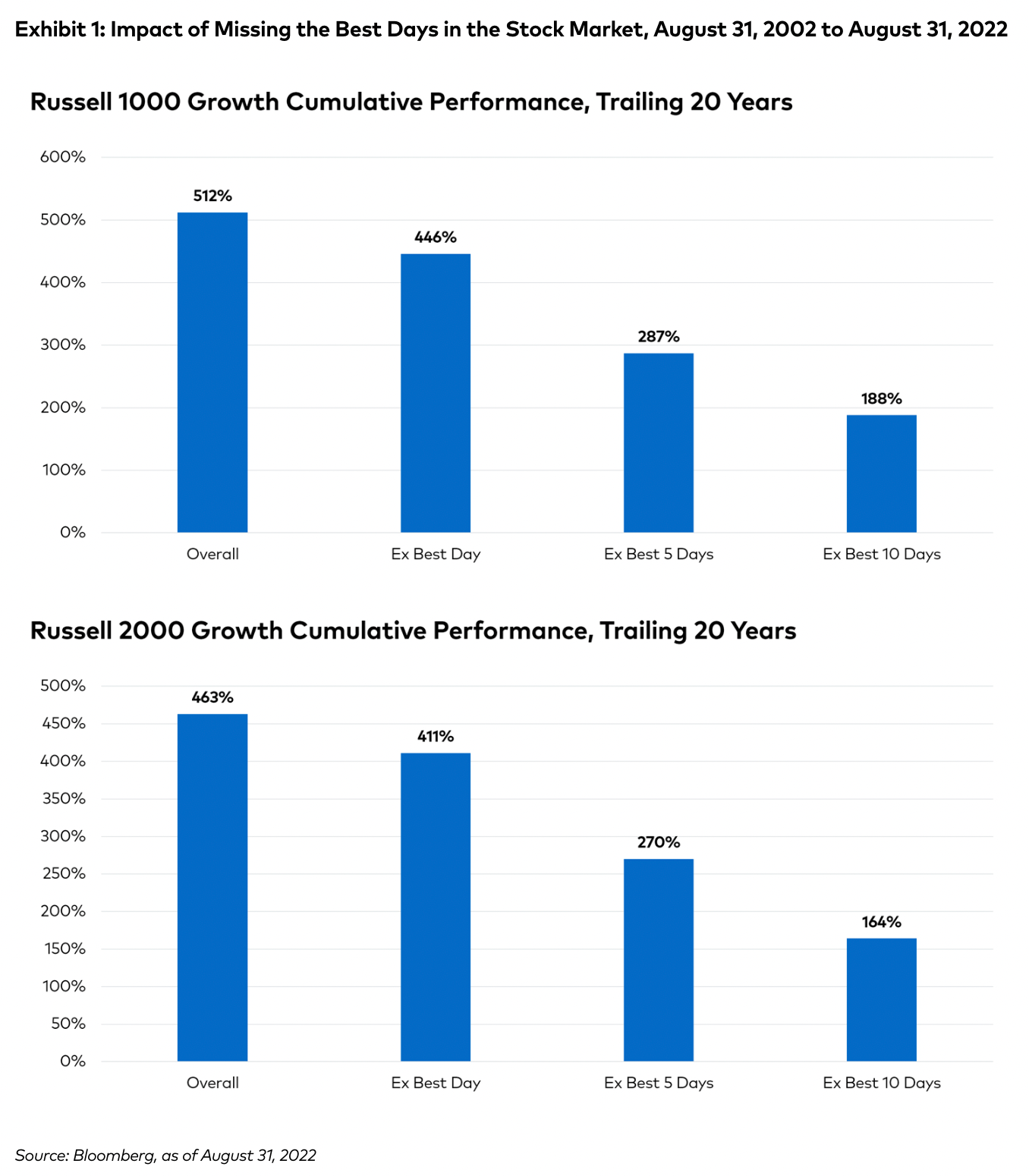

Playing the Infinite Game: Patient Investing

- "In his 2019 book The Infinite Game, author Simon Sinek describes how taking a long-term view — what he calls adopting an infinite mindset — is critical for success."

- By frequently trading in and out of the market, you will miss the greatest effects of compounding and long term growth.

- Investors typically get spooked when the market is falling and sell at precisely the times when they should be buying. Especially if it's a company that they've developed conviction in.

- Trading frequently scratches the itch to "do something" and often leads to poor results in the long term. See in the images below the effects of missing the best market days because you traded out.

- "Patience takes determination, resilience, and the confidence to stand by investments backed by careful, fundamental research. To be clear, being patient isn’t the same as being passive. It’s not about taking your eye off the ball and letting come what may."

BUSINESS

OpenDoor Lost Money on 42% of August Resales

- After going public in 2020, the company deployed its strategy of buying homes algorithmically, renovating, and flipping homes fast (thousands of them). Sometimes flipping them within months or sooner.

- Since the residential real estate market flipped in recent months, OpenDoor lost even more in certain markets. In L.A. they lost on 55% of sales and in Phoenix, 76% of sales.

- Zillow shut down its home flipping business in 2021. OpenDoor took a dig at them stating they were "open for business."

- And now... "'Opendoor’s metrics are in the danger zone,' DelPrete said in an interview. 'They are very close to where Zillow was in its worst moments.'" Mike DelPrete wrote a more detailed piece with the metrics here: For First Time, Opendoor Selling Homes for a Loss

- "Eventually, Opendoor will finish selling through the inventory it acquired before the market shifted..."

Comments ()