The Illusion of Safety, Top 10 EV Battery Makers, OPEC+ Oil Cut, Primary Energy Sources, First 2-Story 3D-Printed House, Celeb Crypto Crackdown

“Treat what you don’t have as nonexistent. Look at what you have, the things you value most, and think of how much you’d crave them if you didn’t have them. But be careful. Don’t feel such satisfaction that you start to overvalue them — that it would upset you to lose them.”

- Marcus Aurelius (via The Rational Walk)

INVESTING

The Illusion of Safety

QTR jogs us through why it might not be a good idea to jump back into the stock market quite yet or, at least, proceed with caution.

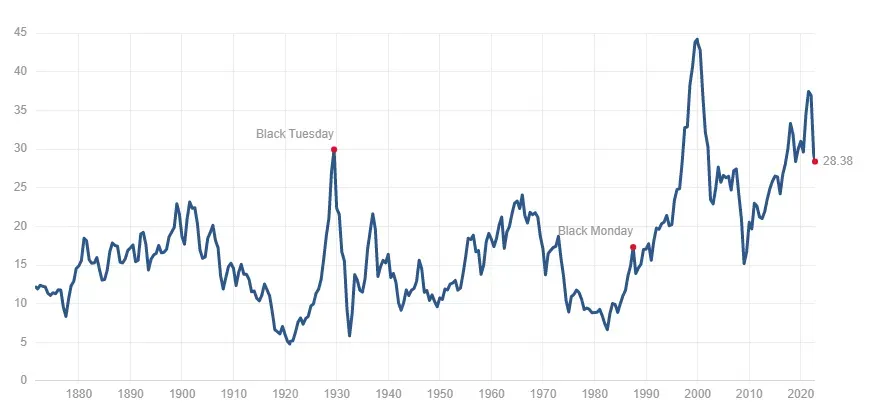

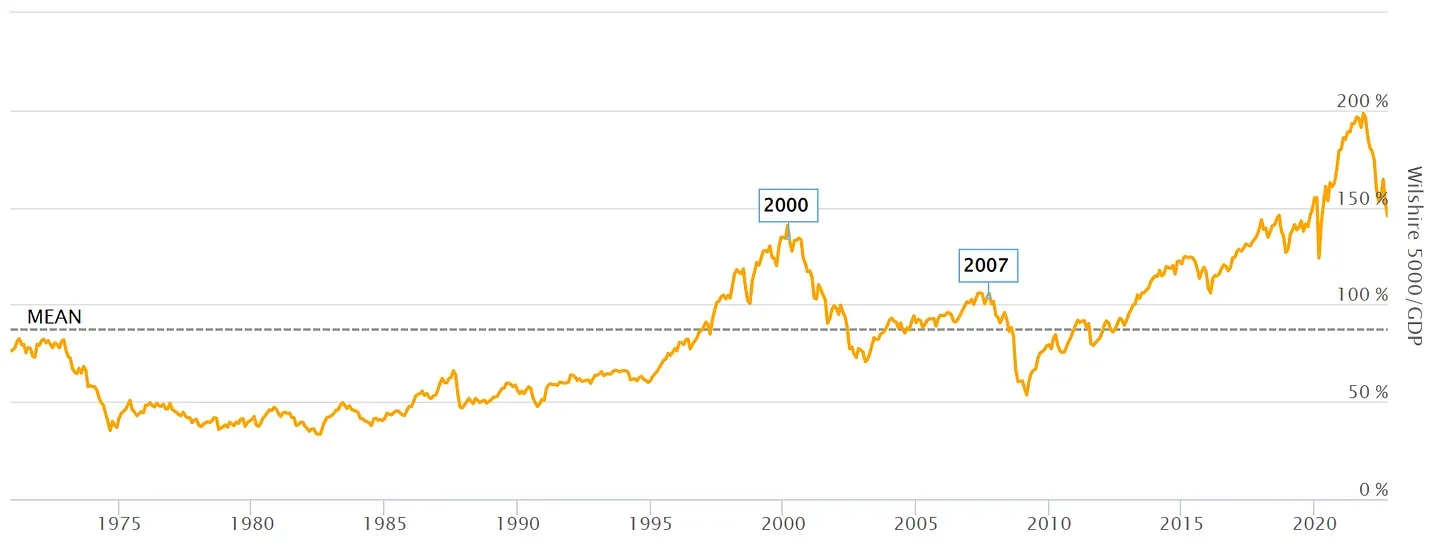

I pointed out over the weekend that I didn’t want to lose perspective of just how expensive the market still was, despite the fact that it had fallen so much. When I went back to the two indicators that I have been using, the Shiller PE and market cap/GDP on Tuesday night, they both provided a necessary dose of reality: the market is still expensive. (QTR)

Below is the total market value of all publicly traded stocks (Wilshire 5000) to the gross domestic product (GDP) metric which was popularized by Warren Buffet who said, in a 2001 Fortune Magazine interview, that "it is probably the best single measure of where valuations stand at any given moment."

As Markets Insider puts it "Warren Buffett's favorite market gauge is reading nearly 150%, signaling US stocks are still overvalued and at risk of tumbling further."

More:

- Carl Icahn made about $250 Million on Twitter stock run-up (Bloomberg)

- The House Always Wins: Sketchy stock trading by elected officials (Graham Stephan)

- Princeton's endowment is now $4.5 million per student (Axios)

- Ray Dalio Makes His Exit From Bridgewater (Institutional Investor)

- Ray Dalio no longer thinks 'cash is trash' (Markets Insider)

- Shorting Is All the Rage for Retail Investors as Stocks Plunge (Bloomberg)

- Making Lemonade in the Stock Market (The Irrelevant Investor)

- Back to Fundamentals (HumbleDollar)

- More Tech IPOs From 2021 Burn Cash Today Than 2019 & 2020 Debuts (The Information)

- Thinking About the Next Warren Buffett (Neckar's)

ECONOMICS

- Cullen Roche: "This has been one of the fastest and most aggressive Fed rate hikes in history" (Pragmatic Capitalism)

- The global economy is not a zero-sum game (Market Sentiment)

- Environmental and Political Elites Are Destroying Food Production for "Climate" Goals (Mises)

- UN to Central Banks: Stop Raising Rates or Risk Tanking the World Economy (Cheddar)

- Eurozone inflation hit a record 10% in September amid energy crunch (WSJ)

- GDPNow Forecast Rises to 2.7 Percent Annualized Despite Weak Economic Data (Mish Talk)

BUSINESS

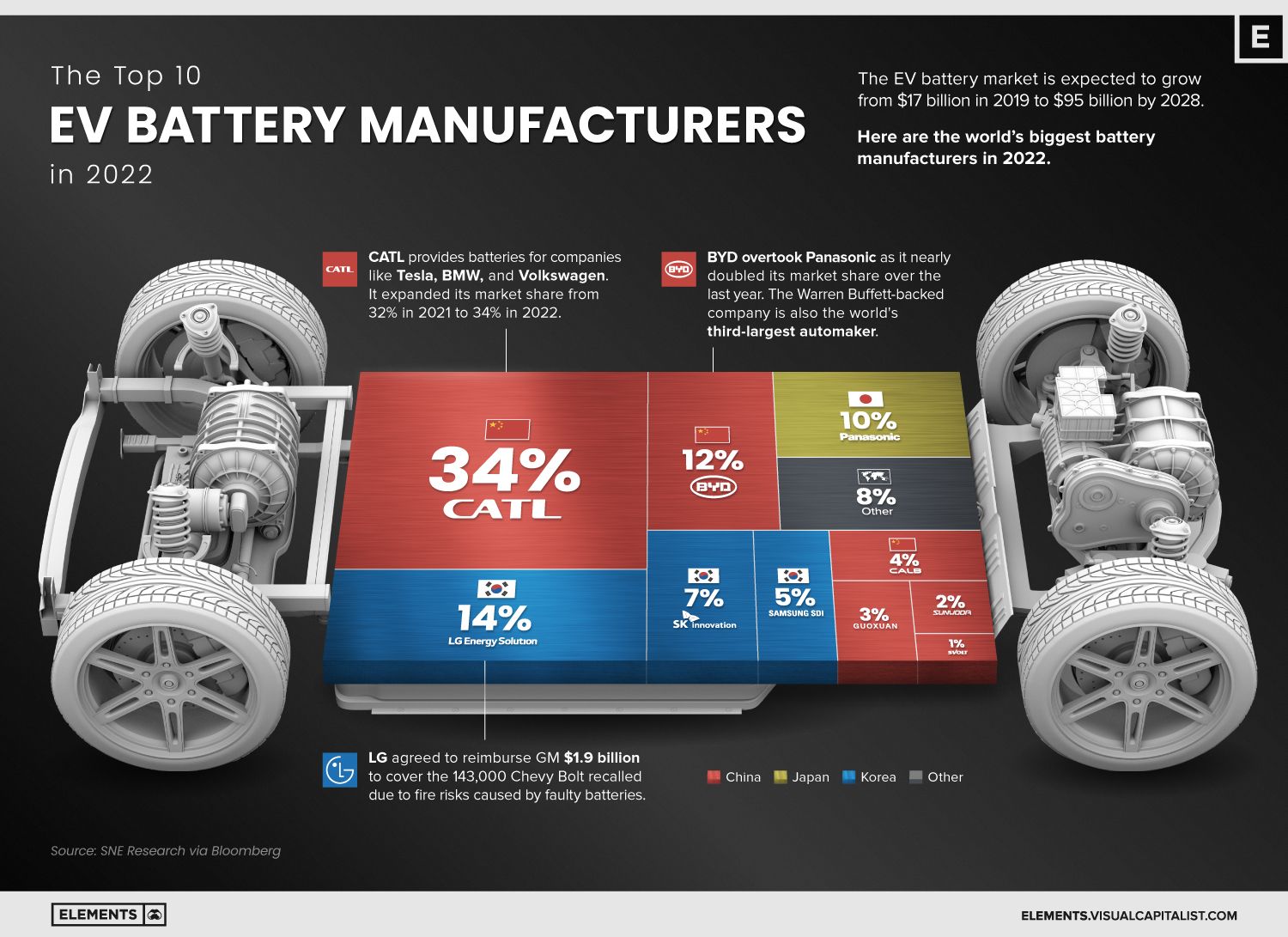

The Top 10 EV Battery Manufacturers in 2022

The global electric vehicle (EV) battery market is expected to grow from $17 billion to more than $95 billion between 2019 and 2028. Despite efforts from the United States and Europe to increase the domestic production of batteries, the market is still dominated by Asian suppliers. The top 10 producers are all Asian companies. Currently, Chinese companies make up 56% of the EV battery market, followed by Korean companies (26%) and Japanese manufacturers (10%). (Elements)

More:

- Micron To Spend $100 Billion To Build Computer Chip Factory In New York (CNBC)

- Goodwill launches e-commerce platform (Axios)

- Micron Pledges Up to $100 Billion for Semiconductor Factory in New York (NY Times)

- Drop in Business School Applications (WSJ)

- Apple will be forced to use USB-C ports on iPhones from late 2024 to comply with EU rules (Reuters)

- Apple’s App Store revenue declined 5% YoY - biggest drop since Morgan Stanley started tracking it (TechCrunch)

ENERGY

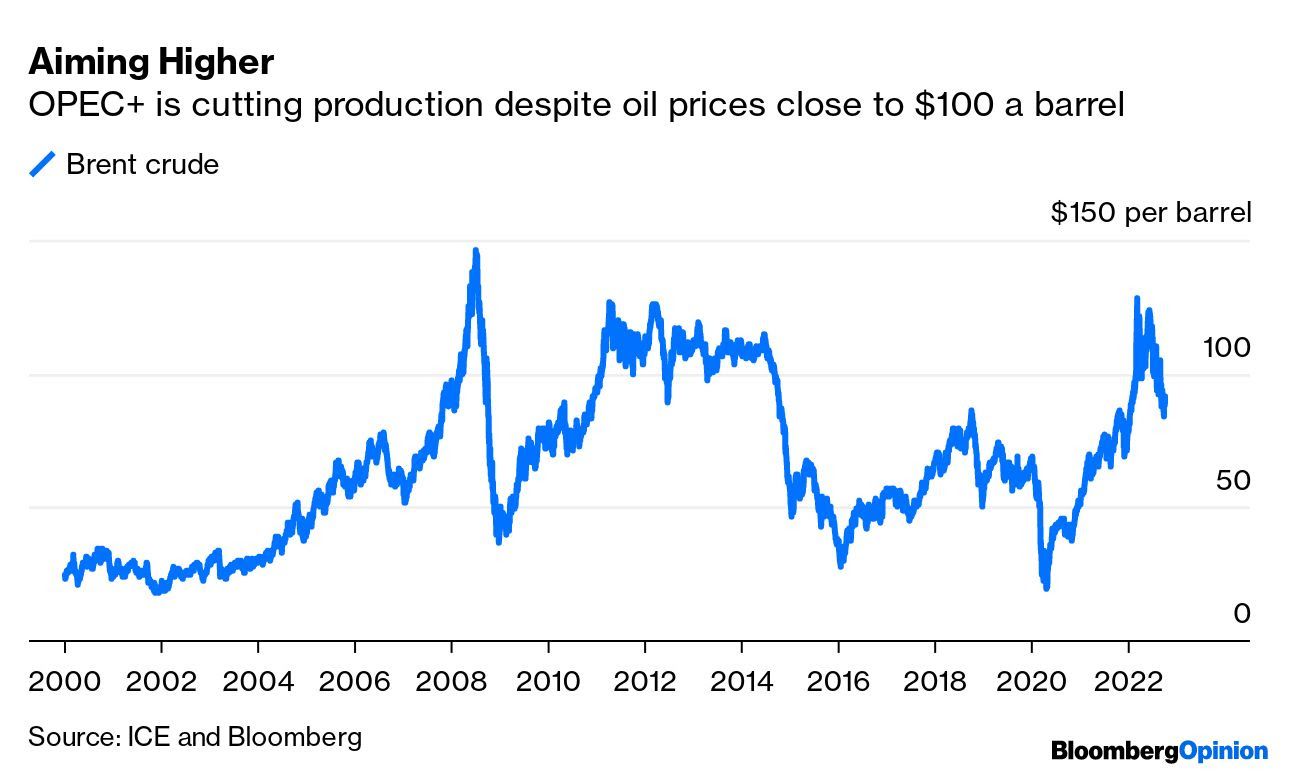

OPEC+ Cuts Oil Output by 2 Million Barrels Per Day

The specter of OPEC+ even considering such a large cut as global oil supplies are tight has sent the Biden Administration reeling. White House spokesman John Kirby on Wednesday said that the United States needed to be less dependent on OPEC+ and other foreign producers of oil. The White House was reportedly in a panic leading up to the meeting, trying to prevent OPEC+ from taking such a “hostile act”. (OilPrice)

OPEC+'s decision is a massive snub to Western governments facing the worst energy crisis in half a century, Javier Blas writes. The cartel has never curbed output so much, and so quickly, while Brent was still flirting with $100 a barrel. (Bloomberg)

Gas, Oil & Coal Still Primary Sources of Energy Globally

More:

- Russia’s Gazprom suspended gas flow to Italy (WSJ)

- Debunking Fossil Fuel Hysteria: An Interview with Alex Epstein (Mises)

- World Bank ‘has given nearly $15bn to fossil fuel projects since Paris deal’ (The Guardian)

- How Waves Of Reality Are Swelling Upstream Returns (Forbes)

- Qatar Sets Its Sights On Becoming The World’s Largest LNG Trader (OilPrice)

- China processed least crude oil since early 2020 in Q2 2022 (EIA)

- European Gas Moves from Bad to Ugly (Rigzone)

REAL ESTATE

The first 2-story 3D-printed concrete home in the US is taking shape in Houston

A 4,000-square-foot two-story 3D-printed home is now being built in Houston. This multi-story home will be the first of its kind, according to the companies behind the project. Texas is becoming a hub of 3D-printed real estate in the US. (Insider)

More:

- Application Volume Plunges to 25 Year Low (Mortgage News Daily)

- Apartments: Net Absorption Very Low in Q3, New Construction Deliveries Even Lower (Calculated Risk)

- Manhattan apartment sales declined 18% in Q3 (CNBC)

- Why homebuilders are in panic mode (The Hustle)

CRYPTO

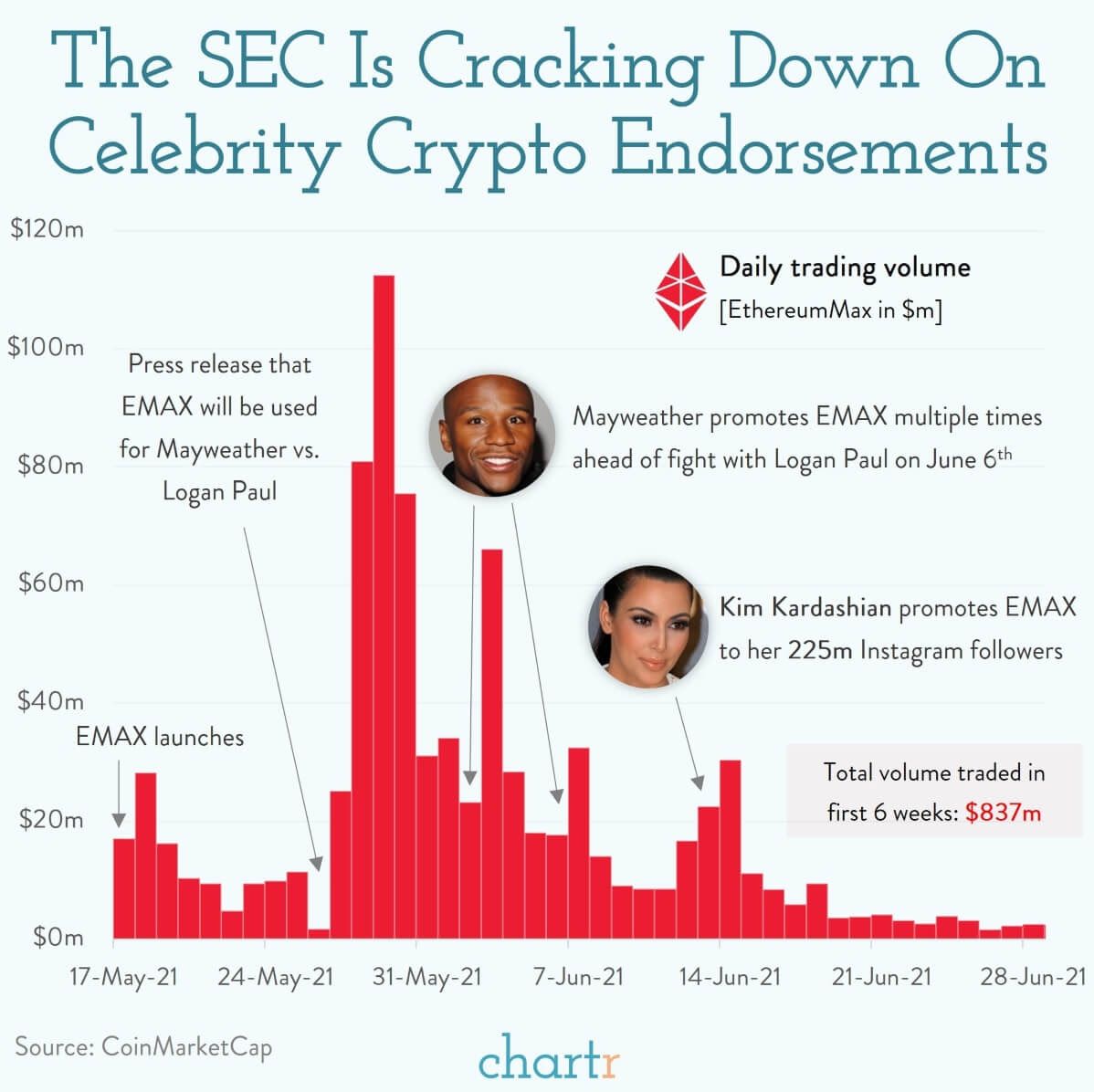

SEC Cracking Down on Celebrity Crypto Endorsements

Kim Kardashian is handing over $1.26m to settle a lawsuit surrounding a crypto advert she posted for EthereumMax on Instagram back in June 2021.

The social media star asked fans ‘ARE YOU GUYS INTO CRYPTO????’ before touting the EMAX asset to her 200m+ Instagram audience, never stopping to disclose the fact that she was paid some $250k to do so. (Chartr)

More:

- Nasdaq Waits For Regulatory Clarity Before Launching Its Crypto Exchange (Bloomberg)

- McDonald Set To Accept Payments In Tether And Bitcoin In Lugana, Switzerland (Bitcoinist)

- Why Is Crypto Full of Scams? (Bankless)

- How Bitcoin Mining Can Help Power Companies Optimize Generation Assets (Power)

- Terra CEO Do Kwon to lose his passport within a month (Forkast)

- Three Arrows Capital's NFT collection to be liquidated (Coin Telegraph)

Comments ()