Spooky Dotcom Bust Parallels, Worst Inflation, OPEC Fights The Fed, Tokyo Shoebox Apartments, Top 10 Housing Market Affordability

“The capacity to mass-produce books was incredibly subversive to medieval institutions, just as microtechnology will prove subversive to the modern nation-state.”

- The Sovereign Individual: Mastering the Transition to the Information Age

Big Tech Stocks Plunge with Spooky Parallels to Dotcom Bust: -25% to -66% from Highs so Far

Wolf Street provides a list of percentage declines by sector. Also a list of Big Tech declines from their highs and shows us what date they were last at current levels.

When a bubble like this unwinds, it can get brutal. As Cisco and Intel show, some of the stocks may “never” recover to their bubble highs – “never” meaning either “never” or just beyond a reasonable time frame for long-term investors. During the years of the dotcom bust and the years that followed, hundreds of stocks vanished, either going to zero or getting bought for a few bucks a share. We only remember the winners to come out of the dotcom bust and thrive, such as Amazon. But Amazon was a rare exception.

Details @ Wolf Street

More:

- Bill Ackman: This Is Another Great ‘Moment’ To Buy Stocks (Acquirer's Multiple)

- The search for a better guide to stock values (Nuggets of Investing Wisdom)

- How Does Quality Work? Asset growth drives returns for high profitability companies (Verdad)

- Wisdom of Great Investors (Davis Funds)

Inflation accelerated more than expected in August; Worst in decades.

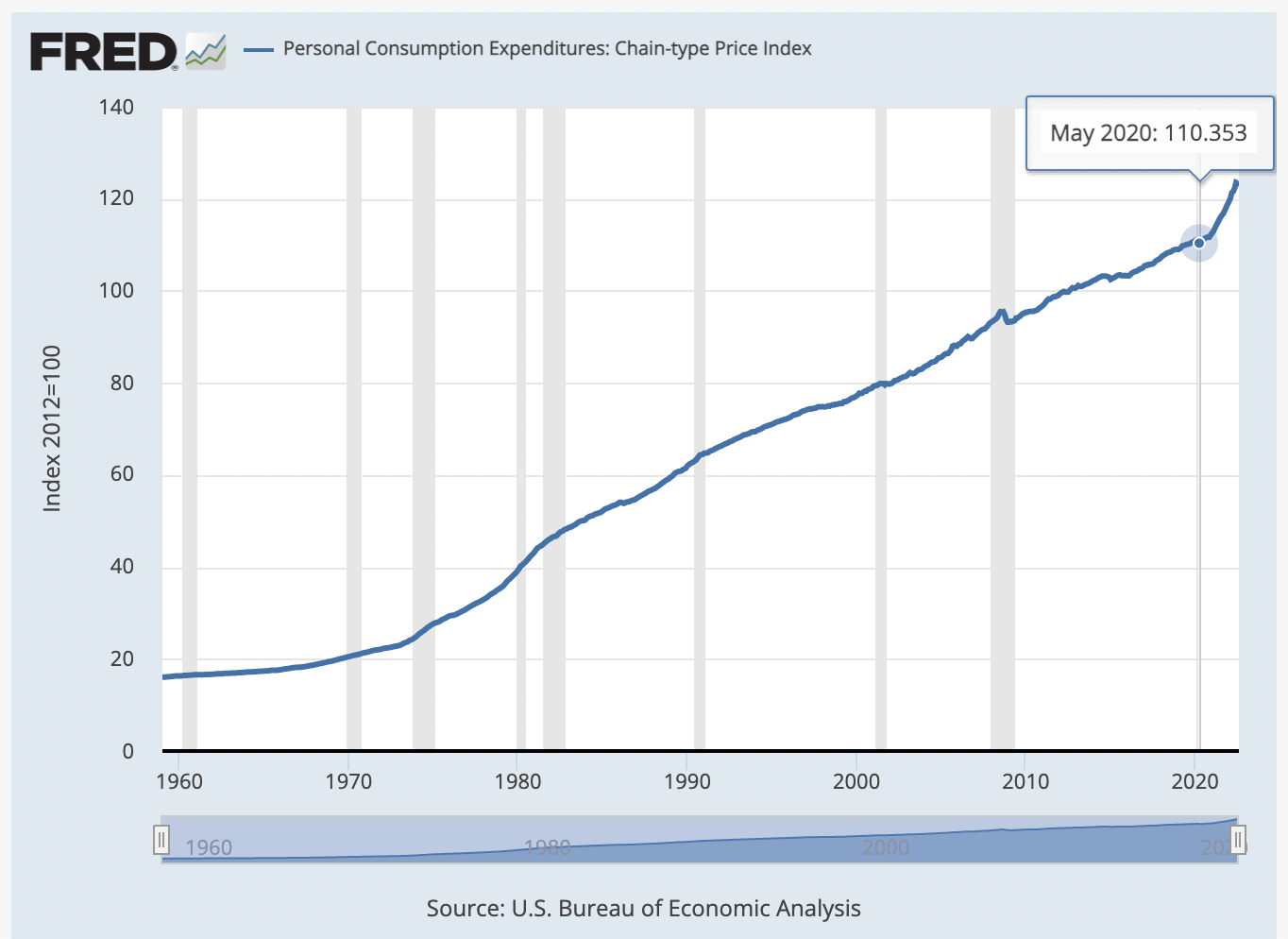

From the Fed's preferred inflation gauge, PCE:

The personal consumption expenditures [PCE] price index excluding food and energy rose 0.6% for the month after being flat in July. That was faster than the 0.5% Dow Jones estimate and another indication that inflation is broadening/ On a year-over-year basis, core PCE increased 4.9%, more than the 4.7% estimate and up from 4.7% the previous month. (CNBC)

Here's another take on this, and a visual on the history of this gauge, going back many decades, where there is a notably extreme incline starting around May/June 2020:

While CNBC went on to describe the bad metrics within the PCE inflation gauge, it never quite said outright that this was the worst inflation reading on that gauge in decades — just worse than expected. However, it was, in fact, the worst in decades... (The Great Recession Blog)

More:

- U.N. Calls On Fed, Other Central Banks to Halt Interest Rate Increases (WSJ)

- ‘Danger Zone’ Markets Need Fed To ‘Print Dollars’: Wilson (Heisenberg Report)

- Cargo Shipowners Cancel Sailings as Global Trade Flips From Backlogs to Empty Containers (WSJ)

- The IRS and Another Multi-Billion-Dollar Mistake (Armstrong Economics)

- U.K. Government Abandons Plan to Cut Rate of Income Tax for Top Earners (WSJ)

- $46 Trillion in Financial Wealth Has Already Been Lost During The Great Global Market Crash of 2022 (The Economic Collapse)

- The Fed's Strong Dollar Policy: A Recipe For Systemic Implosion (Matterhorn)

- How SpaceX innovates by moving fast and blowing things up (FutureBlind)

- Peloton to put bikes in all Hilton-branded hotel in U.S. (CNBC)

- UnitedHealth completes Change Healthcare merger after court rejected DOJ challenge (Fox Business)

- Understanding the New Economics of Reality TV (Inc.)

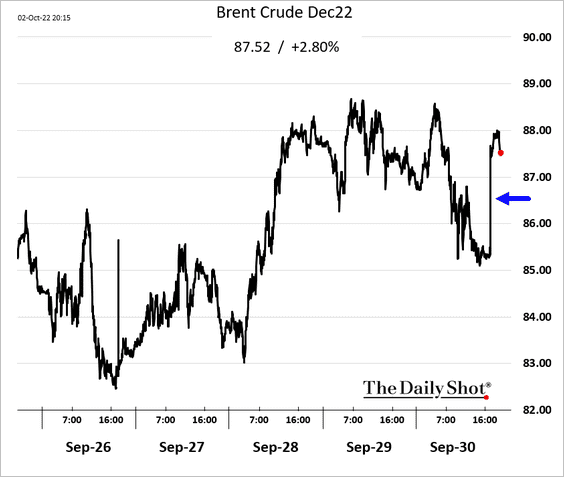

OPEC Fights the Fed, Crude Jumps 3 Percent on Expected Output Cuts

Details @ Mish Talk

Levelized Cost of Energy (LCOE): Is Solar really the cheapest power option? Maybe not...

Matt Loszak shares insight into the real cost of solar. LCOE ignores the "cost of unreliability."

Levelized Cost of Energy, or LCOE, is the total cost of a project, divided by the total energy that it produces in its lifetime.

What LCOE ignores, is the cost of unreliability...it could be a terrible investment for the grid, and society at large.

Imagine we were talking about two internet providers: Sun Internet Co, and Atom Internet Co. Sun Co charges $1 / GB, while Atom Co charges $5 / GB. But Sun Co only works from 9am–5pm, and its speed drops by 80-90% on cloudy days.

Full thread below...

Millions of people mistakenly believe that Solar is now our cheapest option for powering the grid.

— Matt Loszak (@MattLoszak) September 30, 2022

What's misleading them?

A sneaky metric known as LCOE. 🧶👇 pic.twitter.com/VuqJItqBHj

More:

- Europeans 'must lower thermostats to prepare for Russia turning off gas supplies' (Euronews)

- Rees-Mogg tells Tories he’d welcome fracking in his back garden (The Guardian)

- China Is Rerouting U.S. Liquefied Natural Gas to Europe at a Big Profit (WSJ)

- More U.S. LNG heads to Europe despite output constraints (Reuters)

- Can Power Plant Wastewater Be Valuable? (Power)

A 95 Sq. Ft. Tokyo Apartment: ‘I Wouldn’t Live Anywhere Else’

Meet the young Japanese who have decided to live in a shoe box.

Details@ The New York Times]

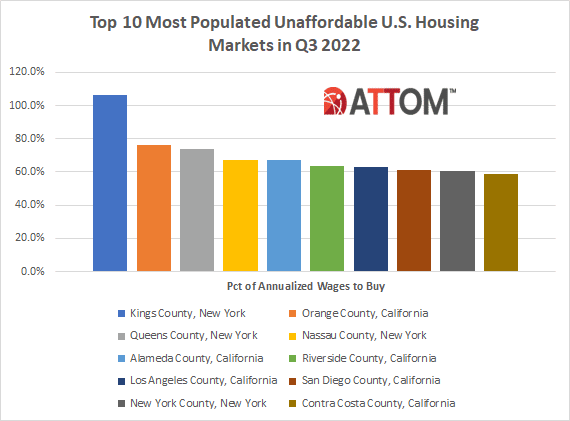

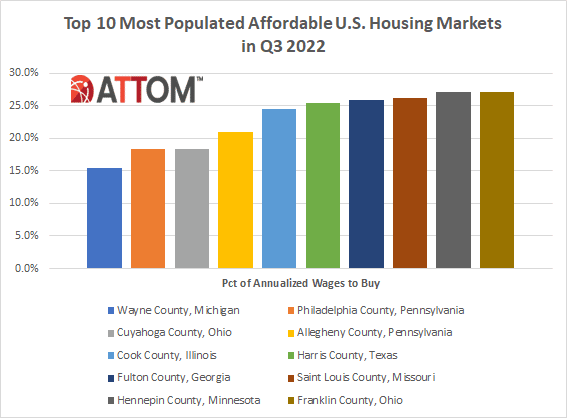

Top 10 U.S. Housing Markets Most and Least Affordable in Q3 2022

ATTOM’s just released Q3 2022 U.S. Home Affordability Report shows that median-priced single-family homes and condos remain less affordable in Q3 2022 compared to historical averages in 99 percent of U.S. counties analyzed.

Details @ ATTOM

More:

- Home prices are dropping like it’s 2009 (HousingWire)

- 44% of UBS survey respondents plan to buy residential property in next 12 months (CNBC)

- U.S. Mortgage Delinquencies Continue to Decline (DSNews)

- Construction Numbers Boosted by Residential Remodeling (Mortgage News Daily)

- Home price appreciation slows to pre-pandemic rate (NMN)

- SEC Charges Kim Kardashian for Unlawfully Touting Crypto Security (SEC)

- Banks Around the World Have Over $9,200,000,000 in Crypto Asset Exposure (Daily HODL)

- The Dangerous Implications Of Central Bank Digital Currencies (Bitcoin Magazine)

- Japanese Gaming Giant Sega to Launch First Blockchain Game (Bitcoin.com)

- NYDIG CEO and President Become the Latest Crypto Execs to Step Down (Crypto Potato)

Comments ()