Rate Hikes by Country, Bearish Sentiments, Visual Income of U.S. tech firms, Ex-WaMu CEO: 'We Are In A Bigger Bubble Today Than In 2007!'

"You need to know the market's going to go down sometimes. If you're not ready for that, you shouldn't own stocks. And it's good when it happens."

- Peter Lynch

- Retail investors are very bearish right now...

Mom and pop have given up.

— SentimenTrader (@sentimentrader) September 22, 2022

This week joins just 4 others in 35 years with more than 60% of respondents being despondent in the AAII survey.

One year returns after the others: +22.4%, +31.5%, +7.4%, +56.9%.

But, of course, this time is different. pic.twitter.com/N42aE3szim

- Navigating the Pain of Your First Bear Market (A Wealth of Common Sense)

- Deepest drawdowns in past 10 yrs for big tech stocks (The Irrelevant Investor)

- John Rogers: When To Sell Stocks (The Acquirer's Multiple)

- Crypto May Be Down, But Global Adoption Is Still High (DataDrivenInvestor)

Interest Rate Hikes Will Persist

Central banks around the globe have continued to raise interest rates in an effort to counter elevated inflation. Notably, Switzerland emerged from a negative rate with a 75 basis point hike to 0.50% and Sweden's Riksbank with a 100 basis point hike to 1.75%. Today, the Bank of England raised by 50 basis points to 2.25%, the highest level in 14 years. You can count on these recent, and future, rate hikes to persist and continue slowing economic growth for the foreseeable future. Although savings account rates will be higher, you still don't get a high enough rate to beat inflation. The impact of the hikes on pocketbooks are emerging as costlier credit cards, car loans and mortgages.

List of interest rates by country: Global-rates.com

'We Are In A Bigger Bubble Today Than In 2007!' - Former CEO Of Washington Mutual On Today's Market

- When Will This Officially Be Called A Recession? (Forbes)

- Europe’s Destructive Energy Policy (Hoover Institution)

- The Most Splendid Housing Bubbles in Canada (Wolf Street)

- US Mortgage Payments Up 45.5% YoY (Confounded Interest)

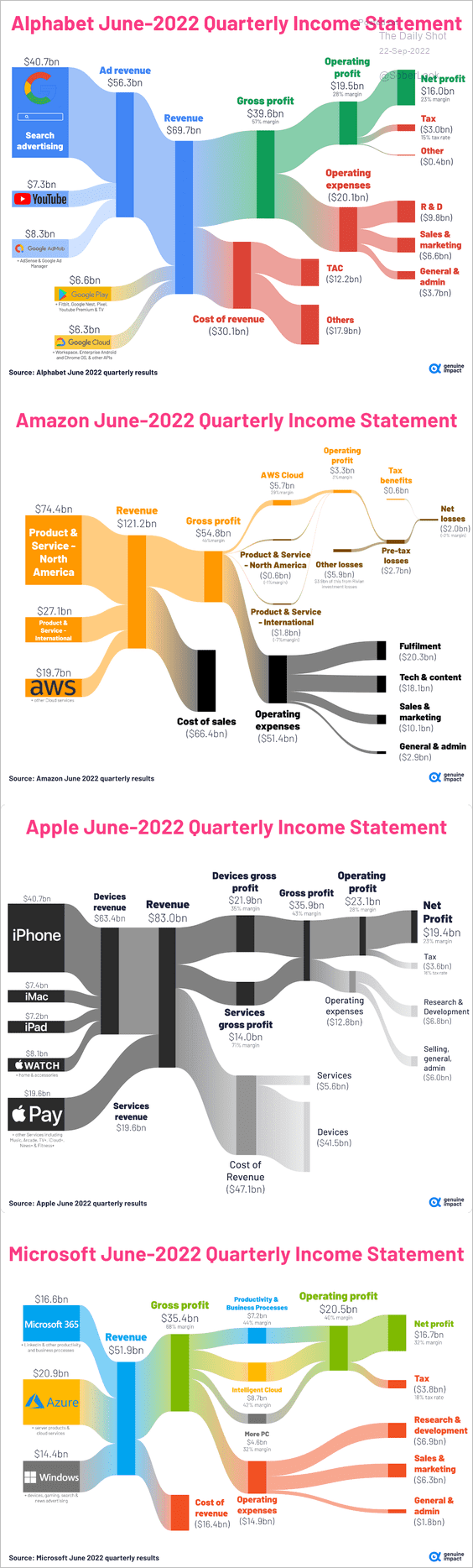

Visualized income statements of big U.S. tech companies

Read the full article at Visual Capitalist

- The Sneaky Genius of Apple’s AirPods Empire (Bloomberg)

- 12 mega landlords own majority of the San Francisco Bay Area (Fast Company)

- FedEx, UPS Rate Rises Are Making Online Shopping More Expensive (WSJ)

- FedEx’s Pricing Power Isn’t Working and Won’t Last (Bloomberg)

- Costco’s quarterly results indicate it's thriving despite high inflation (CNBC)

Comments ()