Millionaires, Housing Market Risk, Green Rebellion, "Hike Until It Breaks"

Millionaire Statistics: How Many Americans Are Millionaires?

- 21,951,000 people in the U.S. have a net worth of $1 million or more.

- Among all states, New Jersey has the most millionaire households.

- Only 3% of American millionaires received an inheritance of $1 million or above.

- Real estate makes up about 40% of a typical millionaire’s net worth.

- China, Japan, Germany, the U.K., France, and Australia added together have fewer millionaires than the U.S.

- The typical American millionaire owns just one property (43%).

(Finmasters)

There are now 210 U.S. housing markets at risk of 15% to 20% home price declines, says Moody’s

- "...over half of the nation’s largest regional housing markets are vulnerable to home price declines of 15% to 20%. These 210 "significantly overvalued" housing markets include places like Boise (overvalued by 72%), Charlotte (overvalued by 66%), Austin (overvalued by 61%), Las Vegas (overvalued by 59%), and Phoenix (overvalued by 57%)." (Fortune)

Death increases the sales of published authors

- "...using data on bestseller lists at week level for 30 years (1975-2005) we have carried out an empirical analysis to study the impact of an author’s death on the sales of his/her books. We have used a Regression Discontinuity Design and showed that in the period immediately following his/her death the probability of entering in the bestseller list increases of about 4-5 percentage points, which corresponds to an impact of more than 100%." (papers.ssrn.com)

Value Investor's Guide to Web3

- "Web3 is attracting a flood of investor interest but is rife with hype and speculation. A value investing approach can help. We adapt our “intangible value” lens to crypto and build a value strategy in small-cap tokens. We also create Web3 industry classifications and crypto stock portfolios."

(Sparkline Capital)

Overtrading is a failure of vision

- "If we truly see the risk and reward in front of us, we can stop and do the right thing. Overtrading is a failure of vision. We are looking at the market, but not seeing opportunity and threat." (TraderFeed)

How the Fed Screwed Up the Housing Market

- "The Fed made two big mistakes in the housing market: (1) They waited too long to raise interest rates. (2) They allowed mortgage rates to rise too quickly once rates began to tick up." (A Wealth of Common Sense)

Stuart Varney: The West’s obsession with climate change is getting ridiculous

- "It’s getting ridiculous. We are pursuing extreme, painful policies that just don't deliver. Case in point: electric vehicles. If every country in the world achieved its stated goal for EV sales by 2030 (and that’s a stretch), the temperature of the planet would be reduced by 0.0002 degrees Fahrenheit by the end of the century. That analysis comes from a committed environmentalist, Bjorn Lomborg, who used the United Nations' own climate model!" (FOX Business)

Bjorn Lomborg: "People will rebel against green policies"

- "When people are cold, hungry and broke, they rebel. If the elite continues pushing incredibly expensive policies that are disconnected from the urgent challenges facing most people, we need to brace for much more global chaos." (City A.M.)

Cathie Wood Goes Wild On 'Dip Buying' Amid Stock Market Rout

- "Bloomberg data shows Ark bought 27 stocks across its eight exchange-traded funds. The largest buy was Roku under the flagship ARK Innovation ETF (ARKK). It's now the third largest holding. Tesla is the first, and Zoom Video Communications is the second." (ZeroHedge)

It’s Time To Embrace Another 25% Decline In The S&P 500

- "Jamie Dimon predicted an economic hurricane was approaching way back in the spring of the year, and now it's hurricane season. The Fed’s already aggressive actions are having a deep impact on the housing market, at least, which is showing signs of implosion." (ValueWalk)

- "As if the CPI data wasn’t bad enough, accelerating on all levels to new highs, the PPI data does not point to a slowdown in inflation."

Wise Words from Charlie Munger

- "There are huge advantages for an individual to get into a position where you make a few great investments and just sit back and wait: You’re paying less to brokers. You’re listening to less nonsense. And if it works, the governmental tax system gives you an extra 1, 2, or 3 percentage points per annum compounded." (Novel Investor)

One Bank Warns A "Hike Until It Breaks" Accident Is Now The Most Likely Market Scenario

- "It is now clear to an increasing number of recency-bias-blinkered investors that The Fed's historical modus operandi is very much back in play - after unleashing liquidity supernovas, they tighten 'until something breaks'..." (ZeroHedge)

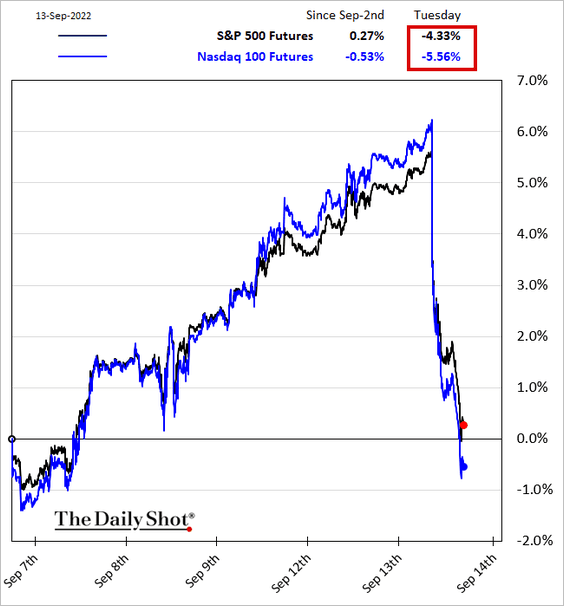

Stocks saw the worst one-day rout since 2020.

Comments ()