Anti-Consumer 'ESG' Investing, Unemployment Rate Falls, The Industry Power Curve, TikTok Losses Swell, French Uranium, Mortgage Rates 20 Year Highs, Zillow's Last Flips, Digital Yuan Expiry Date

“Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note that word ‘selected.’ You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”

– Warren Buffett, 1996 letter

INVESTING

The Tide is Turning on Anti-Consumer "ESG" Investing

You might have missed it (mainly because mainstream media ignored it), but this week another state, Louisiana, put Larry Fink and BlackRock on notice for manipulating our economy through their "Environmental, Social, and Governance" investing practices.

In Louisiana, State Treasurer John Schroder announced that the state would completely divest itself from nearly $800 MILLION in BlackRock investments by the end of 2022. Like his peers West Virginia Treasurer Riley Moore and Texas Comptroller Gleen Hegar, John Schoder has had enough. In a scathing letter to BlackRock CEO Larry Fink, Treasurer Schroder dropped the hammer saying, "Simply put, we cannot be party to the crippling of our own economy."

Details @ Consumers' Research

More:

- How to Manage Risk of Randomness in Investing (Safal Niveshak)

- Looking at the Rise of Money Losing Companies (Validea)

- Why The Bear Market In Stocks May Only Be Halfway Through (Felder Report)

- Will the Stock Market Fall if Earnings Fall? (A Wealth Of Common Sense)

- Can You Get Rich With Compound Interest? (FinMasters)

- 3 Reasons International Investing Hasn’t Paid Off (Morningstar)

- 25 years later, and we still can’t find evidence of persistent growth (Verdad)

ECONOMICS

Unemployment rate falls to 3.5% in September, payrolls rise by 263,000 as job market stays strong

- "Nonfarm payrolls increased 263,000 for the month, short of the Dow Jones estimate for 275,000.:"

- "The unemployment rate was 3.5%, down 0.2 percentage point as the labor force participation rate edged lower."

- "Average hourly earnings rose 5% from a year ago, slightly below the estimate."

- "Leisure and hospitality, health care and business and professional services led sector gainers."

Details @ CNBC

More:

- Why a good jobs report is bad news for the Fed (HousingWire)

- Comments on September Employment Report (Calculated Risk)

- Why The Fed is Always Late to the Party (Barry Ritholtz)

- A global recession is almost certainly coming and the Fed is to blame, according to the UN (Fortune)

- Most Contorted Job Market Ever Struggling to Revert to Normalcy? (Wolf Street)

- U.S. Consumer Borrowing Has Reached Record Highs (Forbes)

BUSINESS

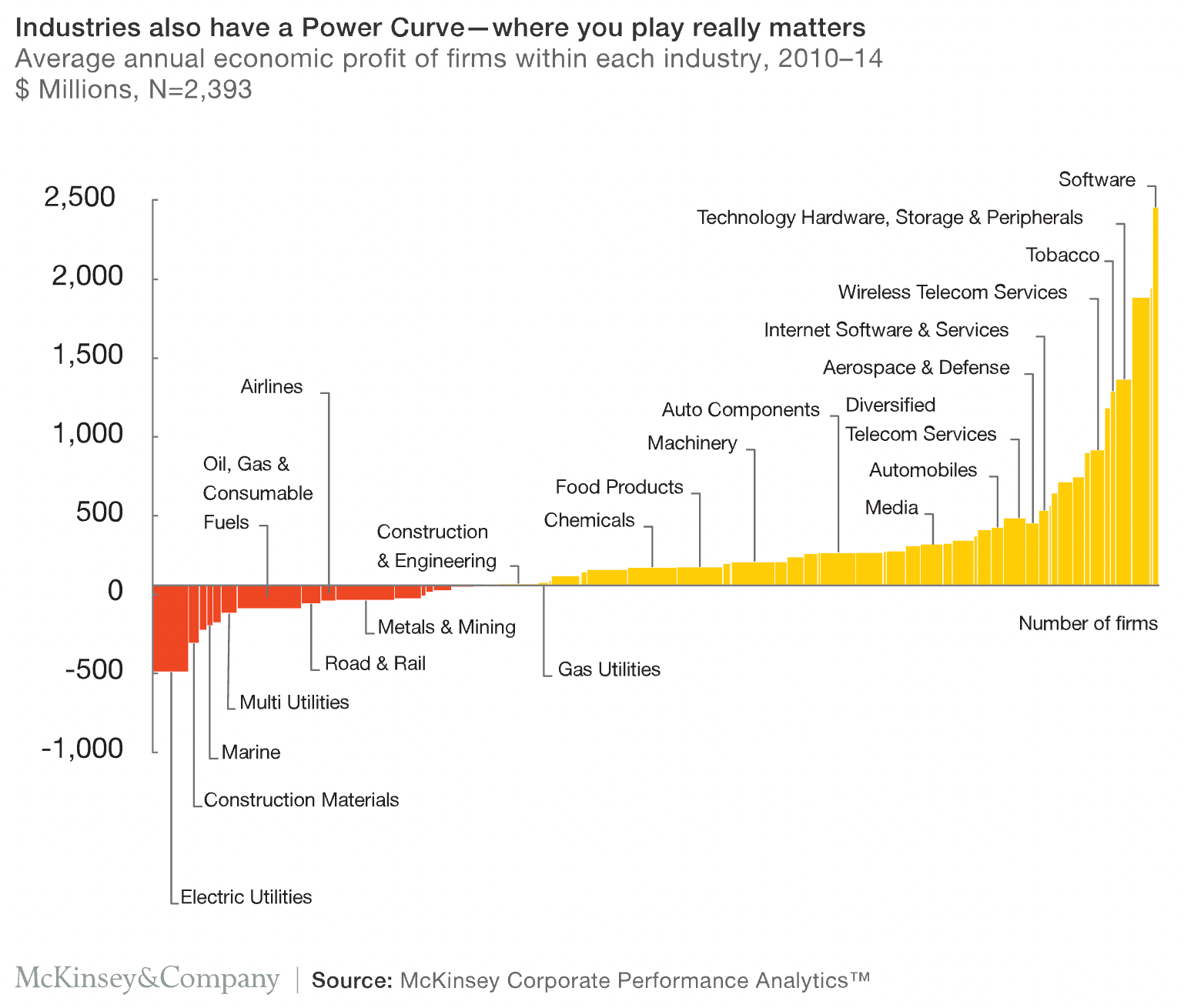

The Industry Power Curve

McKinsey examined the publicly available information on dozens of variables for the world’s 2,393 largest companies. Here they lay out their average economic profit by industry.

There are 12 tobacco companies in our research, and nine are in the top quintile. Yet there are 20 paper companies, and none is in the top quintile. The role of industry in a company’s position on the Power Curve is so substantial that you’d rather be an average company in a great industry than a great company in an average industry. In some cases, you’d rather be in your supplier’s industry than in your own. For example, the average economic profit of airlines is a loss of $99 million, while suppliers in the aerospace and defense category average a profit of $453 million.

TikTok Parent ByteDance Sees Losses Swell in Push for Growth

TikTok parent ByteDance Ltd. saw its operating losses more than triple last year to above $7 billion as it spent heavily to continue its torrid growth, according to a financial report shared with employees that offers a rare look inside the private company’s closely guarded finances.

As a private company based in Beijing, ByteDance has closely guarded its finances and doesn’t publicly disclose results. The report—sent to employees in August and that covers the full years for 2020 and 2021 as well as the first quarter of 2022—provides one of the most detailed looks at how it is performing and is planning for the future. (WSJ)

More:

- Buffett's likely successor buys into Berkshire (CNBC)

- Rivian recalls nearly almost all of its vehicles (Business Insider)

- FTC Pares Lawsuit Targeting Meta's Bid for Virtual-Reality Company (WSJ)

- Several robot makers just pledged to not make robots that can hurt you (Fortune)

ENERGY

France Mulls New Uranium Plant to Cut West's Reliance on Russia

French state-controlled uranium producer Orano SA is considering growing its capacity to enrich the radioactive ore into nuclear fuel by almost 50% as Western governments and utilities seek to reduce their reliance on Russia since its attack on Ukraine.

Details @ Bloomberg

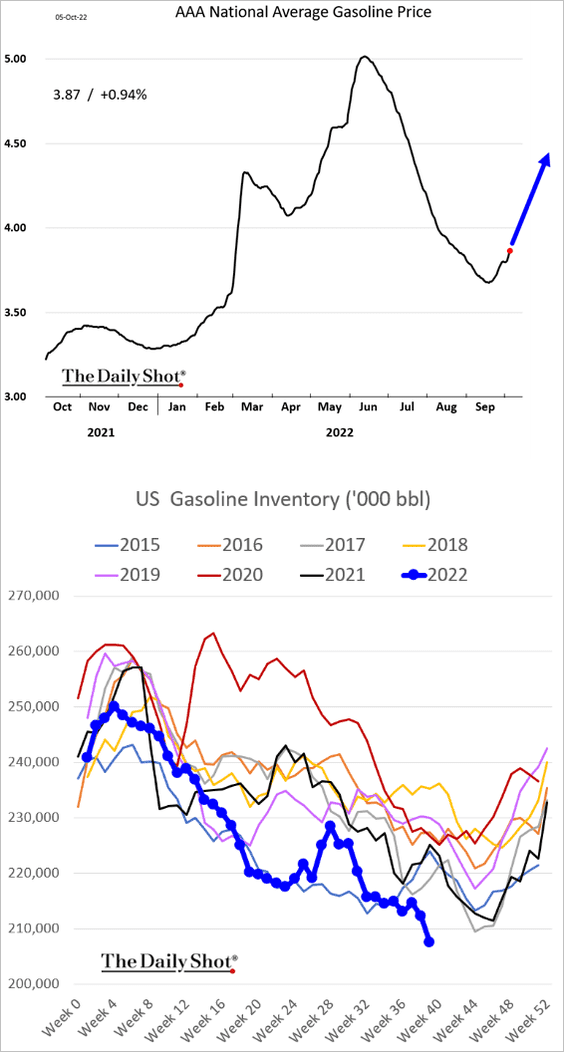

Gasoline prices are going higher as inventories tumble.

More:

- Oil Achieves Largest Weekly Gain Since March on OPEC Cuts (Rigzone)

- U.S. is considering retaliatory action against OPEC’s decision to slash oil production. (WSJ)

- Morgan Stanley Boosts 2023-24 LNG Price Forecast on Europe Demand (Bloomberg)

- The OPEC+ Cut Is A Disaster For President Biden (OilPrice)

- The new oil war: OPEC moves against the US (FT)

REAL ESTATE

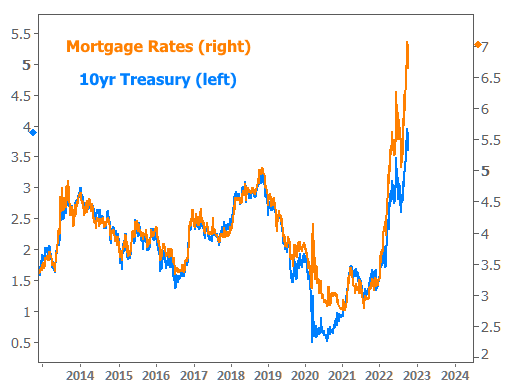

Rates Back to 20 Year Highs as Economy Remains Resilient

... we can compare Treasuries and mortgage rates which, as of Friday, moved back up to the highest levels in 20 years.

Why are rates so high? That's a question that we've been answering again and again throughout 2022, but the answer hasn't really changed in terms of its essential ingredients. They are as follows: Incredibly high inflation, Remarkably resilient economic data, And to a lesser extent, a recent stint of incredibly rate-friendly Fed policies that require a bit of unwinding.

Details @ Mortgage News Daily

Zillow iBuyer flipping program officially ends as last homes leave the market

A year after announcing it would abandon its iBuyer program, Zillow has offloaded the last of the homes it bought with Zillow Offers, marking the end of a major chapter in real estate history

Details @ Inman

More:

- Realtor.com Reports Weekly Active Inventory Up 30% Year-over-year; New Listings Down 17% (Calculated Risk)

- What’s a ‘tornado housing market?’ Hint: You might be in one right now (Inman)

- Growing Affordability Constraints Persist for Buyers (DSNews)

- Senior housing wealth surpasses $11.5 trillion (Reverse Mortage Daily)

- Homebuyer optimism continues to shrink (NMN)

- Average Office Occupancy Rate in 10 U.S. cities is about 47% (Bloomberg)

CRYPTO

Expiration Date Of Digital Yuan Could Lead To Bitcoin Explosion

The new digital yuan could make Bitcoin attractive. The absurd measure to make unused currency worthless may benefit Bitcoin.

Using its prototype Central Bank Digital Currency (CBDC), the Chinese Communist Party wants to implement an expiration system under the pretext of a “warming” of the economy.

The design consists of a removal of the currency from the bank accounts of users who have not used it in the time the government stipulates.

Details @ Bitcoin News

Bitcoin is Element Zero (a film) by Ioni Appelberg & Knut Svanholm and narrated by Guy Swann

More:

- Flare Network (FLR) Details Anticipated Launch, ‘Large Airdrop’ for XRP Holders (The Daily HODL)

- Don’t Call It A Hack: Crypto Reacts To The Binance Smart Chain Exploit And Halt (Bitcoinist)

- Visa Launches Bitcoin, Crypto Debit Cards In 40 Countries In FTX Partnership (Bitcoin Magazine)

Comments ()