10 Investing Tips From Superinvestor Peter Lynch

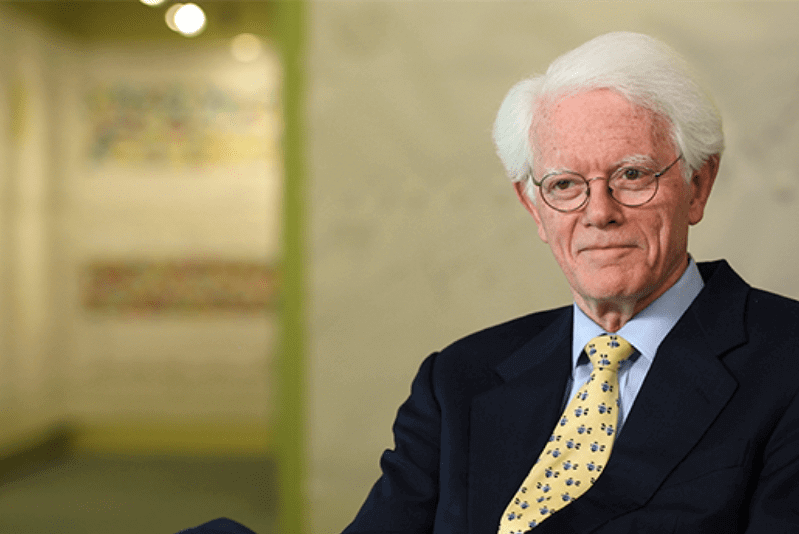

Peter Lynch is one of the most successful investors of all time, having managed the Fidelity Magellan Fund from 1977 to 1990. During his tenure, he grew the fund's assets from $20 million to $14 billion, earning an average annual return of 29.2%. Lynch's investing wisdom has been sought after by investors of all stripes, and here we will explore some of his most famous quotes which relay his solid investment principles.

- “Know what you own, and know why you own it.”

Lynch is a firm believer in doing your own research and understanding the fundamentals of the companies you invest in. He wants investors to know why they're investing in a particular stock, and to be able to explain why it's a good investment. - “If you can’t find any companies that you think are attractive, put your money in the bank until you discover some.”

Lynch is a proponent of taking a long-term approach to investing, and he is not afraid to miss out on short-term gains if he doesn't believe in the fundamentals of a company. He advises investors to be patient and wait until they find an attractive opportunity. - “The key to making money in stocks is not to get scared out of them.”

Lynch is a believer in the power of staying invested for the long run. He believes that investors should not be scared out of their investments when the market dips, as it is usually a temporary phenomenon. - “If you’re terrific in this business you’re right six times out of ten. You’re never going to be right nine times out of ten.”

Lynch wants investors to understand that even the most successful investors make mistakes. Investors need to be realistic about their expectations and understand that even the best investors are wrong from time to time. - “Invest in companies that have a ‘wonderful’ product or service.”

Lynch tells investors to focus on companies that have a unique product or service that could provide long-term value. Stay focused on the fundamentals of a company, rather than just its short-term stock price. - “If you don’t study any companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.”

Lynch encourages investors to truly understand the importance of doing their own research before investing in any company. Thoroughly review the fundamentals of a company before investing in it, just as one would study their cards before making a bet in a poker game. - “If you’re prepared to invest in a company, you ought to be able to explain why in elementary language.”

Investors should be able to explain why they are investing in a particular company in simple terms. Investors should really understand the finances and fundamentals of the company they're investing in, and be able to explain why it's a great investment. - “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Investors must understand the importance of staying invested for the long run. Lynch advises investors to avoid trying to time the market, as it can often lead to losses. - “If you don’t understand a business, don’t invest in it.”

Again, Lynch presses investors to grasp the serious importance of doing their own research before investing in a company. Understand the fundamentals. - “It’s not necessary to do extraordinary things to get extraordinary results.”

Investors don’t need to take big risks to achieve big returns. He wants implores investors to focus on the fundamentals of a company and invest in companies that they can really understand.

Peter Lynch's investing wisdom has been sought after by investors of all walks of life. His quotes provide valuable insight into the world of investing and serve as a reminder to investors to focus on the fundamentals of great companies and to be patient when investing. We can sum his advice up as diligent yet simple. By following Lynch's advice, investors might increase their chances of success in the stock market and achieve abundant long-term returns.

We leave you with one last quote...

"There are 60,000 economists in the U.S., many of them employed fulltime trying to forecast recessions and interest rates. If they could do it successfully twice in a row, they'd all be millionaires by now. As far as I know, most of them are still gainfully employed, which ought to tell us something."

- Peter Lynch

Comments ()