China Real Estate Bubble Latest

Gathering some of the latest information on the Chinese real estate bubble.

From "'The emperor has no clothes': Why China's reputation for economic management is coming undone" (Morningstar):

"Polls show China's international reputation deteriorating ... stresses in the real estate sector have hit speculators hard, with real estate prices in China declining for the 11th month in a row in August."

From Investing.com:

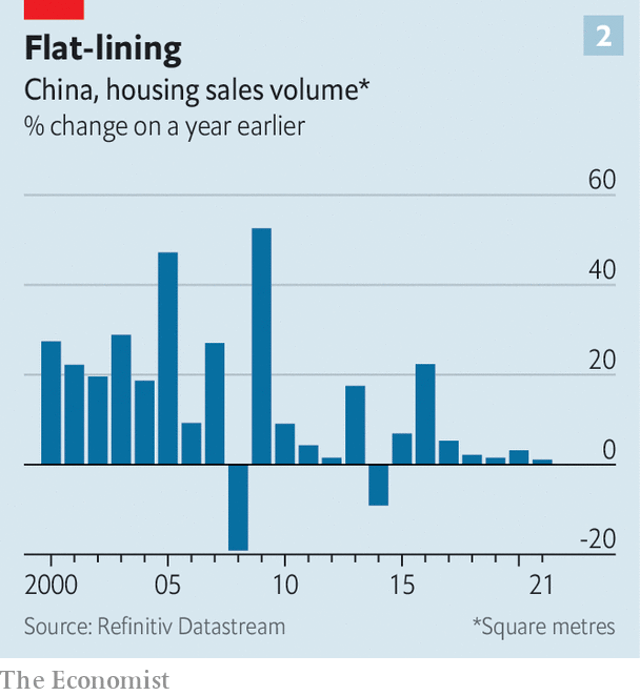

"Property sales [in China] are expected to drop by 24.5% in 2022, according to a Reuters survey of analysts and economists in late August, a far bigger drop than the 10% fall forecast in the May poll.

The stakes are high as figures from America’s National Bureau of Economic Research indicate that real estate, including allied activities, contributes as much as 29% to China’s GDP and has been a key driver of its sustained economic growth.

Moreover, around 70% of household wealth in China is stored in property."

Here's a few excerpts from an aptly titled article in The Economist: "China’s ponzi-like property market is eroding faith in the state":

Local governments have filled their coffers by selling vast tracts of land to developers. An astonishing 70% of Chinese household wealth is now tied up in real estate.

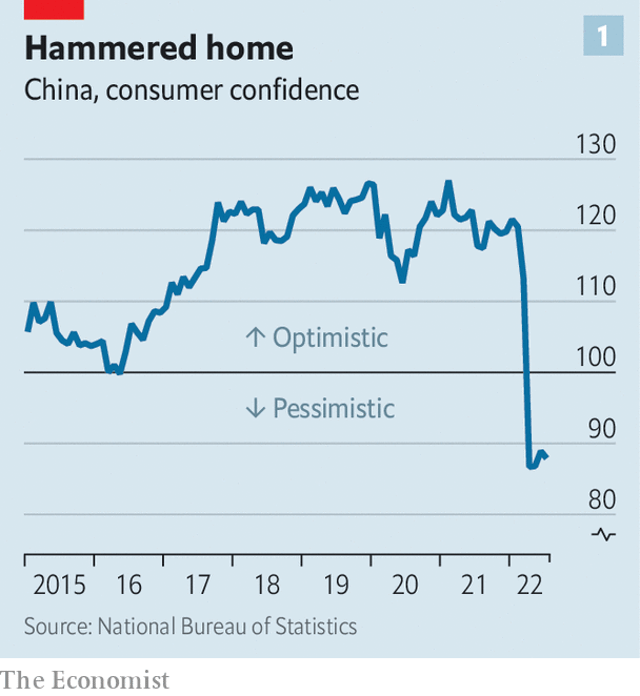

To undermine trust in this model is to shake the foundations of China’s growth miracle. With sweeping covid-19 lockdowns and a crackdown on private entrepreneurs, this is happening on many fronts. But nowhere is it clearer than in the property industry, which makes up an estimated 25% of gdp. New project starts fell by 45% in July compared with a year ago, home sales by 33% and property investment by 12%. The effects are rippling through the economy, hitting furniture-makers and steelworkers alike. The blow to confidence comes at a critical time for Xi Jinping, China’s leader, who will probably be granted a third term at a party congress in October.

And...

China’s developers are highly reliant on selling homes long before they are built, so as to generate liquidity. Last year they pre-sold 90% of homes. But without access to bonds and loans, as banks reduce their exposure to the property sector, and with new sales now falling, the Ponzi-like nature of the property market has come into full view.

But...

Potential homebuyers have dropped out of the market. Far more worrying, though, are the millions of people waiting, often for years, for homes for which they have already paid. Just 60% of homes that were pre-sold between 2013 and 2020 have been delivered.

In the following video, Stoic Finance posits that the Chinese government largely is, or was, funded by land sale profits from the construction market. He also discusses the "pre-sales" and how people bought apartments as investments, that were basically empty shells. Eventually it came to be that almost 100% of these units were investments not owner-occupied. That created the "ghost cities" phenomenon.

The Financial Times has created a list of "Debt Monsters" with a total 207 companies, the top of list is taken mostly by over-leveraged Chinese property companies that need to "defy the laws of financial gravity" to stay alive.

Comments ()